Just recently, NBA MVP and Finals MVP Shai Gilgeous-Alexander signed a contract extension that will see him earn a projected $79 million in its final year (2030-31). While an astronomical figure, it places him tantalizingly close to a previously unthinkable milestone: earning a million dollars per game.

This ascent mirrors a historical shift in sports economics. Contrast this with 1979, when MLB pitcher Nolan Ryan made headlines simply by becoming the first professional athlete to earn a million dollars per *year*. The landscape has clearly shifted dramatically.

The journey toward a seven-figure paycheck per game in the NBA is driven by specific financial mechanisms and market dynamics. Understanding these factors reveals not only who might reach this threshold first, but also the broader implications for player compensation and the league`s economic future.

The Engines of Financial Ascent

The primary forces behind the NBA`s rapidly escalating top-tier salaries are twofold: the strategic implementation of the `supermax` contract extension and a robustly expanding salary cap.

The supermax, formally known as the Designated Veteran Extension, was introduced in the 2017 Collective Bargaining Agreement. This allows elite players with specific service time (seven to eight years) and performance accolades (like All-NBA selections) who remain with their drafting team to sign extensions starting at a significant 35% of the salary cap. Shai Gilgeous-Alexander is among a select group of players who have qualified for this lucrative deal.

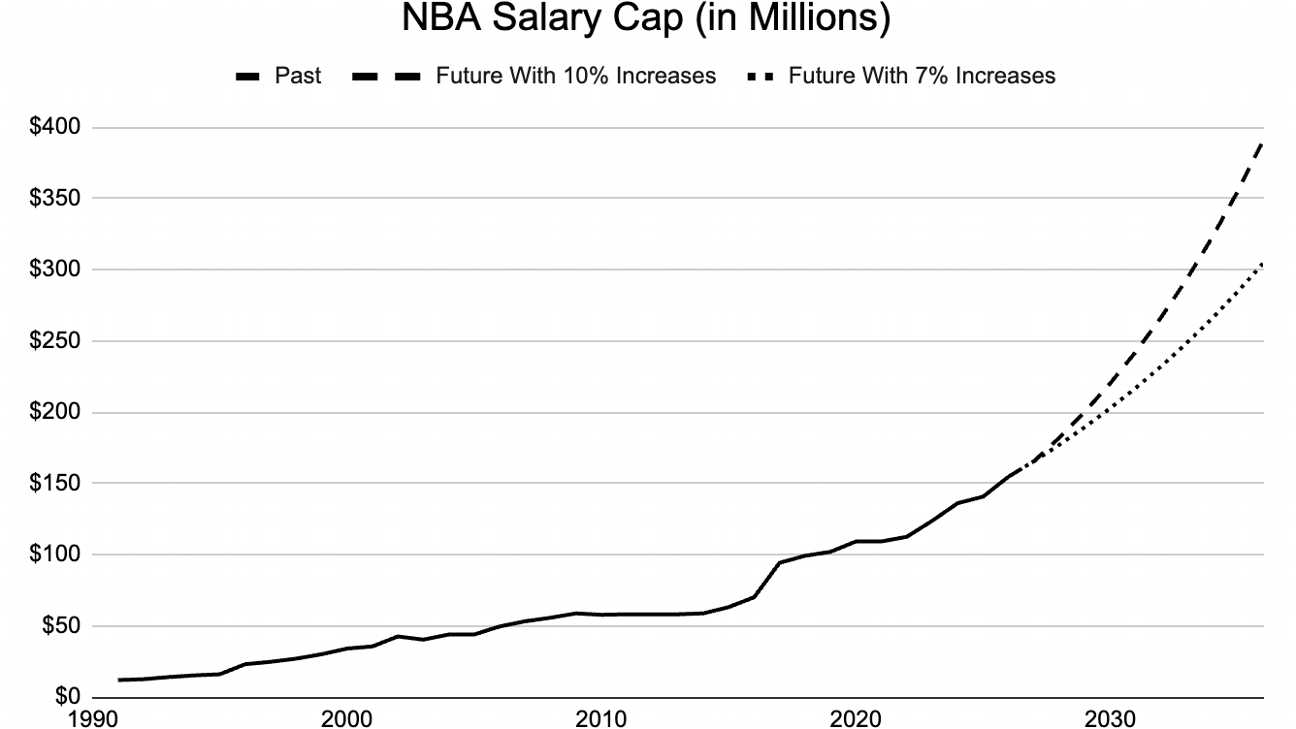

Compounding the effect of the supermax is what could be termed `basketball inflation.` While general economic inflation has increased values over the past decade, the NBA`s financial growth has far outpaced it. The salary cap, which was around $63 million a decade ago (equivalent to roughly $85 million today with standard inflation), reached $141 million for the 2024-25 season. This represents a two-thirds increase beyond expected inflationary trends.

These factors are poised for further acceleration. The NBA has inked a massive new television rights deal, an 11-year agreement worth an estimated $76 billion, or nearly $7 billion per season. This dwarfs the previous deal, valued at approximately $2.7 billion annually over nine years. The new agreement essentially triples the national TV revenue per season.

To prevent a sudden cap explosion like the one that facilitated Kevin Durant`s move to Golden State in 2016, the new CBA includes `cap smoothing` provisions, limiting annual salary cap increases to a maximum of 10%. While the cap is projected to rise by 10% next season, subsequent increases might settle around 7% due to complexities like declining regional sports network revenue. Nevertheless, repeated increases of 7% to 10% will, over time, lead to exponential growth. The salary cap is set to exceed $150 million next season and could potentially double to over $300 million by the early 2030s – the simple power of compound growth.

The impact on supermax salaries is direct and dramatic. Stephen Curry`s pioneering supermax started at $34.7 million in 2017-18 when the cap was $99 million. It took five years for the supermax starting salary to clear $40 million. However, as the cap has climbed, the pace accelerated: three more years to pass $50 million, a projected two more years to exceed $60 million, and just one additional year projected to surpass $70 million. Because supermax contracts include annual raises, the peak salary within these deals rises even faster.

Assuming continued cap increases, even at a moderate 7% annually after 2026-27, players signing supermax deals starting in 2028-29 are projected to see their salaries reach over $82 million (the $1 million per game threshold based on 82 games) by the fourth year of their contracts. Later signing classes will cross this mark even sooner within their deals, with starting salaries potentially exceeding $84 million as early as the 2030-31 season.

The Candidates: Who Reaches $1M Per Game First?

Given that Shai Gilgeous-Alexander`s deal, signed based on his draft class eligibility, falls just shy of the $1 million per game mark by its conclusion, the first players to consistently clear this figure in their annual compensation will likely come from subsequent draft classes.

While the 2019 draft class appears less likely to produce a supermax candidate based on recent performance, the 2020 class features prominent contenders. Anthony Edwards, with consecutive All-NBA Second Team selections, is firmly on track to qualify for a supermax extension potentially starting in the summer of 2027. Such a deal could be worth up to $345 million over four years and would likely push his salary past $82 million within its second season.

The 2021 draft class also offers strong possibilities. Cade Cunningham and Evan Mobley both earned their first All-NBA selections last season, positioning them as future supermax candidates. Other promising players from this class, such as Scottie Barnes, Alperen Sengun, and Franz Wagner, also possess the potential to reach this tier, contingent on their continued development and accolades.

Looking ahead, even younger draftees from the 2022 and 2023 classes, including high-impact players like Jalen Williams, Chet Holmgren, Paolo Banchero, and the exceptionally hyped Victor Wembanyama, could realistically sign future contracts (either supermax extensions or subsequent veteran deals) that exceed $100 million annually based on these financial projections. Even experienced veterans, like Devin Booker whose recent two-year extension averages higher annually than SGA`s supermax, can command nine-figure annual values over shorter terms.

Context: The Global Sports Earnings Landscape

While $1 million per NBA game feels groundbreaking, other sports have already seen athletes earn comparable or higher amounts on a per-game or per-appearance basis.

Top MLB pitchers, starting around 32 games a year, crossed the $35 million annual mark years ago, effectively earning over $1 million per *start*. The impact of a top pitcher on a baseball game is often compared to that of a top NBA player on a basketball game – roughly influencing the outcome in about one in four contests they participate in significantly. This parity in impact suggests a logical alignment in earning potential, though the structures differ.

In the NFL, where schedules are much shorter (17 regular season games), top quarterbacks already earn significantly more per game, sometimes approaching $3 million. This is justifiable given their outsized influence on a game`s result and the league`s immense revenue relative to its schedule length.

Globally, elite soccer players, particularly those recruited by leagues funded by significant sovereign wealth, have reached salary levels that dwarf even the NBA`s projections, with figures rumored to be around $200 million annually.

However, compared to team sports not directly subsidized by state wealth funds, the NBA stands out in the combination of per-game pay and sheer volume. While an NFL quarterback or an MLB ace earns more per appearance, their limited schedules mean their total annual compensation, while enormous, is often surpassed by the total value of the NBA`s lengthier supermax deals. Consider this: next season, the NBA is projected to have 15 players with cap hits of $50 million or more. The NFL, NHL, and MLB combined have a mere two such contracts (as of a recent count) for Juan Soto in MLB and Dak Prescott in the NFL.

Ripple Effects of Soaring Salaries

The ascent towards $1 million per game carries potential ramifications beyond just player bank accounts. One immediate area of scrutiny could be `load management` – the practice of resting healthy players. As player salaries reach such staggering per-game figures, public and media tolerance for stars sitting out could dwindle. The optics of a player making over a million dollars for a game they don`t participate in will undoubtedly draw sharp criticism.

Furthermore, such extreme wealth could subtly alter player motivations in career decisions. While the desire for a maximum contract often represents status and financial security, as annual earnings climb from, say, $75 million to $85 million, the marginal quality-of-life difference might diminish for some. This could potentially make stars more willing to explore free agency rather than automatically re-signing with the team that can offer the most (the supermax), knowing they will still secure multi-generational wealth elsewhere. It might also embolden a few to sign for less than the absolute maximum to provide their teams with greater financial flexibility under the punitive constraints of the second luxury tax apron.

Finally, despite player salaries typically remaining a fixed percentage of league revenue (via the salary cap), the sheer numerical value of these contracts could ignite public debate about whether NBA stars are “overpaid.” However, the financial analysis suggests a different reality for the truly elite.

Are Superstars Worth $1 Million Per Game?

To assess the value proposition, consider the league`s total spending on players and luxury tax payments. Based on recent data, NBA teams collectively spent approximately $5.65 billion in a season. With 1,230 regular-season wins contested, this equates to roughly $4.6 million spent per regular-season win.

Now, evaluate the impact of a top player like Shai Gilgeous-Alexander. Advanced metrics estimated his value at around 20.9 wins last season. Multiplying this by the cost per win ($4.6M) suggests his regular-season value to his team was approximately $96 million. This calculation doesn`t even account for his value in the playoffs, his contribution to ticket and merchandise sales, or his impact on the overall franchise valuation (which, for a player like LeBron James returning to Cleveland in 2014, was estimated to boost value by $100-$150 million instantly).

This analysis highlights a long-standing reality in the NBA: because of maximum contract limits, the league`s absolute best players have historically been compensated at a discount relative to the value they generate. This was true for Michael Jordan before maximums were strictly enforced, and it remains true today. Even at $1 million per game, or over $82 million per year, for the truly franchise-altering, league-defining talents – the equivalents of yesteryear`s Jordans and O`Neals or today`s Gilgeous-Alexanders and future Wembanyamas – this compensation level is likely still less than their true economic impact.

The $1 million per game supermax salary, when it arrives in the next few years, will undoubtedly be a landmark figure. It will capture headlines and symbolize the immense wealth flowing into the league. Yet, viewed through the lens of player value generation, this unprecedented sum for the NBA`s elite may still, surprisingly, represent a bargain.